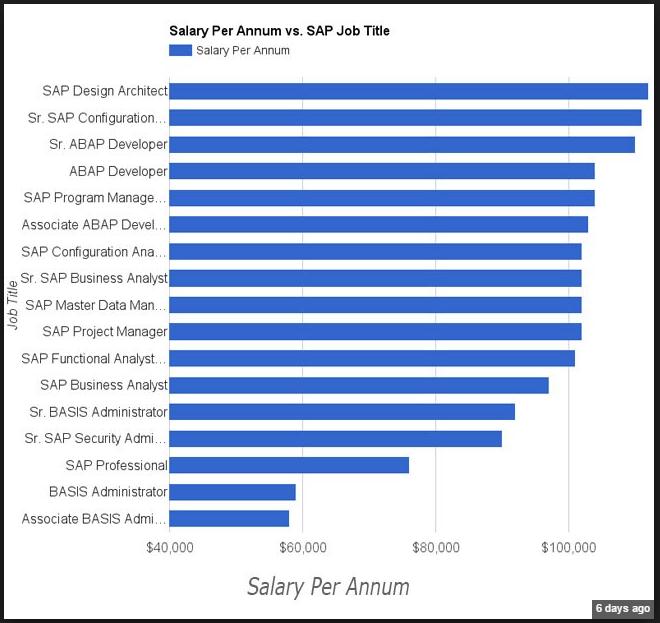

A financial consultant salary can vary depending on the level of education one has. A bachelor's degree in finance or a related field can earn an individual a good salary. For those who are interested in becoming financial consultants, it's a good idea to get a higher education. In addition to education, it's important to be persistent and knowledgeable about current trends in the finance world. Candidates interested in the field should do their research and seek out assistance from an institution like upGrad.

Minimum guaranteed salary as a financial advisor

It depends on what type of financial consulting you offer that the minimum guaranteed salary is. You may be eligible for 7%, 8.8% or 9% depending on your performance and level of experience. A Financial Consultant may also be eligible to receive a higher rate on certain products and services.

The starting salary for associate financial advisors is $94,000 per a year. You can expect more if working in the field for longer periods of time. This level of compensation also includes 12 percent in bonuses and incentives. You could earn as much as $165,000 annually once you reach seniority.

The average annual percentage increase in pay for a financial adviser

Many ways can financial consultants increase their salary. They may be able to move to a higher paying job, pursue an advanced degree, or even become a manager. Their salaries can be boosted by increasing their experience. For instance, if a financial consultant has more than ten years of experience, they are more likely to be promoted and get a higher salary.

A typical financial consultant in Ethiopia will receive a 3% increment every 12 months. Only 35% of employees reported receiving a bonus in the past year. This job is low on bonus. These bonuses were ranging from 3% to 5 percent. The amount of bonuses offered varies depending on how large the company is, but generally, larger companies offer higher bonuses.

Required education to become a financial adviser

There are many educational options available to you if you want to become a financial consultant. You can complete a degree in finance, which emphasizes decision-making and theory. This type of degree prepares students to work in a management capacity or lead a team. It also provides a foundation in financial knowledge and helps students develop leadership skills, research and communication skills. Distance learning is available in certain degree programs. It can provide you with the flexibility to manage your life and your studies.

A bachelor's degree is not required to be a financial consultant. However, it can help you land more jobs. Financial advisors often have a degree in math, accounting, business, economics or math. Financial advisors often have a bachelor's degree in accounting. These programs can also include courses in business ethics, management finance, and financial planning. Many financial advisors also learn on-the-job.

The job is stressful

Although the stress levels associated with a job as a financial advisor are high, they do decrease after a while. Consultants who had been in the field for at least 20+ years reported lower levels stress than those who were only in the profession for a short time. Adopting a mindful attitude is one way to reduce stress.

FlexShares recently conducted a survey and found that financial advisors experience high levels of stress. In 2018, political uncertainty was the most common cause, followed by client growth and compliance. The highest stress levels were reported by regional advisory firms.

FAQ

Do I need to pay tax on consulting income?

Yes, you must pay tax on the consultancy profits. It depends on how much income you make per year.

If you are self-employed, expenses can be claimed on top of your salary. These expenses include rent, childcare and food.

But, interest payments on loans, vehicle and equipment depreciation will not be allowed to be deducted.

You cannot claim back less than PS10,000 in a given year.

But even if you're earning more than this threshold, you might still be taxed depending on whether you're classed as a contractor or employee.

Employees are generally taxed through PAYE (pay as you earn) and contractors through VAT.

Which industries use consultants

There are many different types. Some focus on one particular type of business while others specialize in more than one area.

Some consultants work only for private companies, while others represent large corporations.

And some consultants work internationally, helping companies all over the world.

Why would you want to hire consultants?

There are many factors that could lead to you hiring consultants.

-

Perhaps your company has a specific problem or project you need to address

-

You want to improve your own skills or learn something new

-

You want to work closely with experts in a certain field

-

You have no other choice but to do the job.

-

Feel overwhelmed by all the information available and don't know where you should start

-

You don't have the money to pay someone full time

The best way to find a good consultant is through word of mouth. Ask around if anyone knows any reputable consultants. Ask someone you already know to recommend a consultant.

You can use online directories such as LinkedIn to find consultants in your local area.

Statistics

- According to statistics from the ONS, the UK has around 300,000 consultants, of which around 63,000 professionals work as management consultants. (consultancy.uk)

- According to IBISWorld, revenues in the consulting industry will exceed $261 billion in 2020. (nerdwallet.com)

- "From there, I told them my rates were going up 25%, this is the new hourly rate, and every single one of them said 'done, fine.' (nerdwallet.com)

- 67% of consultants start their consulting businesses after quitting their jobs, while 33% start while they're still at their jobs. (consultingsuccess.com)

- Over 62% of consultants were dissatisfied with their former jobs before starting their consulting business. (consultingsuccess.com)

External Links

How To

How can you find the best consultants?

It is important to first ask yourself what you expect from a consultant when searching for one. Before you look for someone, you need to be clear about your expectations. It is important to make a list with all the requirements you have for a consultant. This might include skills such as project management, professional expertise, communication, availability, and technical skills. Once you have identified your requirements, you might consider asking friends and colleagues to recommend you. Ask your friends and colleagues if they have had bad experiences with consultants in the past. Compare their recommendations with yours. Try searching online for recommendations if you don’t have any. There are many websites, such as LinkedIn, Facebook, Angie's List, Indeed, etc., where people post reviews of their previous work experiences. Use the feedback and ratings of others as a starting point to search for potential candidates. Once you have a shortlist, be sure to contact potential candidates directly to schedule an interview. At the interview, it is important to discuss your requirements and get their feedback on how they can help. It doesn’t matter if the person was recommended to you; it matters that they understand your business goals, and can show you how they can help.